News & Updates

New Washington Sales Tax Rules Effective October 1, 2025

Beginning October 1, 2025, Washington State will expand its retail sales tax to cover several new categories of services, including information technology services, custom website development, investigation and security services (including armored car), temporary...

New Investment Income Voluntary Disclosure Program – Starts July 1, 2025

Beginning July 1, 2025, the Washington Department of Revenue is launching a temporary expanded Investment Income Voluntary Disclosure Program under ESSB 5167. This initiative allows qualifying businesses with unreported investment income subject to B&O tax to come...

Seattle Social Housing Tax (SHT)

What's Happening? Approved and certified in February 2025, Proposition 1A---the Social Housing Tax (SHT)---took effect on January 1, 2025. The SHT imposes a 5% excess compensation payroll expense tax on businesses with individual Seattle employees earning more than $1...

Affiliates Of Insurance Providers Qualify for B&O Exemption

What’s Happening? On 12/12/2024, the Supreme Court of Washington decided the case of Envolve Pharmacy Solutions v. Department of Revenue.[1] The Supreme Court found that the exemption from B&O tax in RCW 82.04.320 applied to Envolve Pharmacy Solutions’ (“Envolve”)...

Antio: Washington Supreme Court Holds Only “Incidental” Investment Income is Deductible

What’s Happening? On October 24, 2024, the Washington Supreme Court affirmed a narrow interpretation of investment income in Antio, LLC v. Department of Revenue.[1] This ruling significantly restricts the ability for a business to deduct investment income for Business...

Publication: “Washington’s New B&O Tax Apportionment Rule,” Tax Notes State

As experts in state and local taxes, our team members often write or contribute to industry articles. We will share excerpts from these publications on our blog for the benefit of our customers and are always available to discuss specifics and answer questions....

Case Study: Apportionment

As consultants specializing in Washington and multi-state taxes, we pride ourselves on deep business knowledge across various industries. It’s our job – and our passion – to keep our eyes on the outcomes of cases across the region so we know exactly how to counsel our...

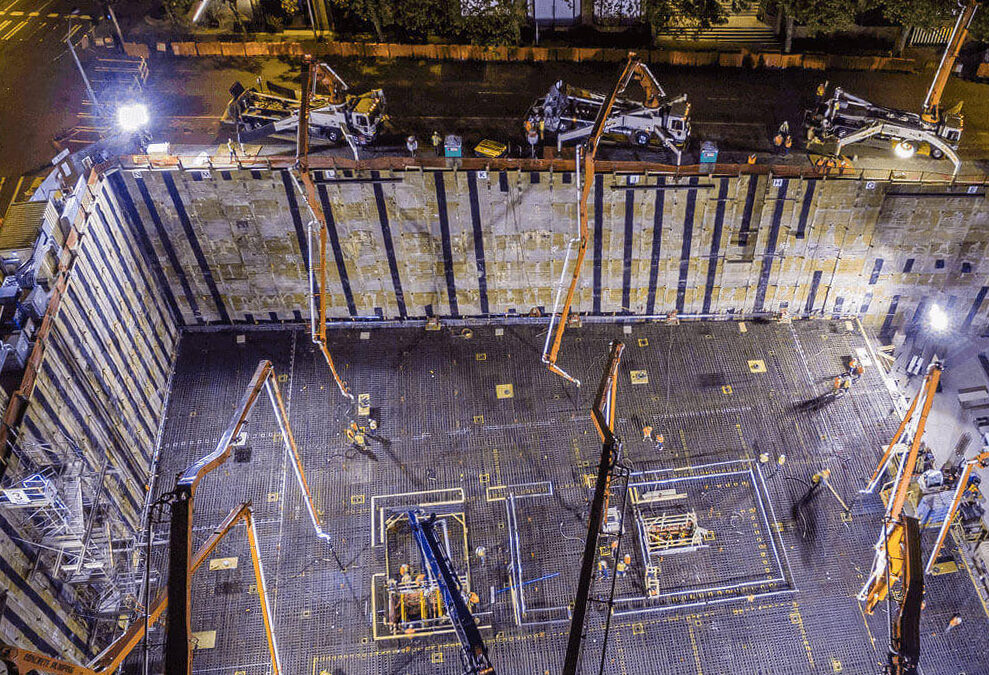

Case Study: Taxing for Concrete Pumping Services

As consultants specializing in Washington and multi-state taxes, we pride ourselves on deep business knowledge across various industries. It’s our job – and our passion – to keep our eyes on the outcomes of cases across the region so we know exactly how to counsel our...

New Look, Same SALT Expertise

You may have noticed a few changes around our website – we’re excited to formally launch our new KOM Consulting brand! As we’ve grown over the last 18 years, we felt it was time to morph and modernize our brand identity to reflect who we are and how we serve our...

Office Manager Position

About the job KOM Consulting, PLLC is a boutique consulting firm based in Seattle, Washington. We provide state and local tax advisory services. Our team includes accountants, corporate tax advisors, lawyers, and data analysts. We are seeking a part-time Office...